The e-commerce vape market is growing, as consumer tastes evolve, e-cigarette technology innovations and the shift from offline to online consumption is occurring on a global scale. Ecommerce vape retailers are now more popular than ever, with millions of people turning to online stores in order to secure vaping products conveniently.

But vape shops have their own set of issues. Traditional payment processors often flag these businesses as high-risk, leading to rejected applications, sudden account closures, or frozen funds. For vape shops the decision of the best payment gateway isn’t simply about buying something online — it’s about your business’s very survival.

This is the reason vape-friendly payment gateways are now more necessary than ever for online merchants in the year 2025. They get the legalese, they back high-risk industries, and they keep you in line between you and your customer. Let us understand

Why Vape Stores Need Specialized Payment Gateways?

Regulatory Challenges in the Vape Industry

Federal and state laws create a mishmash of regulations in the vape industry. In the USA, the FDA has rules around what e-cigarettes and their components are allowed to be marketed and they and their parts are subject to tight distribution regulations. What’s more, card networks such as Visa and Mastercard frequently place extra limitations on vape-related purchases.

These are the major reasons that cause most banks and processors to consider vape businesses as high-risk merchants. This kind of comes with stricter inspection, higher processing fee and a limited list of payment gateways that are willing to work with such business.

Card Networks’ Stance on Vape and E-Cigarette Sales

Major card brands have a cautious approach toward vape and e-cigarette sales. Transactions are heavily monitored to avoid legal liability, especially when age verification and state compliance are not properly handled. This makes standard payment gateways unsuitable for vape stores that can’t meet these strict conditions.

Common Issues with Traditional Processors

Account Freezes, Chargeback Risks, and Sudden Terminations

It’s easy to turn to mainstream processors such as Stripe, PayPal, or Square, but for vape merchants it ends with account freezes, money held, or outright permanent bans. These are platforms that rarely accommodate industries marked as high risk and they close accounts without any notice to its users.

What’s more, vape companies have above average chargeback rates, in particular if products intended to be used by only those over 18 years of age end up being used by underage individuals or have delayed deliveries. Without high risk support merchants frequently end up taking losses or losing disputes.

Importance of High-Risk Merchant Support

For this reason, it is essential to choose amongst the payment gateways that support high-risk industries. Such providers are of the type that provide functionalities such as:

- Advanced chargeback prevention tools

- Age verification integration

- Custom compliance settings

- Higher approval for vape businesses

Once you choose from the list of vape-friendly payment gateways, it will keep you compliant and allow operations to run smoothly, ensuring your customers trust in your due diligence and expertise.

Key Features to Look for in a Vape Payment Gateway

Picking the best vape payment gateway is about more than providing a transaction support. What you need is a high risk merchant account solution with strong protection, good compatibility, and affordable rates.

High-Risk Merchant Support

Vape-friendly payment gateways understand that you’re subject to specific compliance and regular gateways won’t support that. A high-risk merchant account are prepared for regulatory scrutiny, and help you retain a reliable merchant account without the risk of a surprise sudden shutdown.

You must look for payment gateways option that offer:

- Customized underwriting for vape programs

- Acceptable chargeback ratio as per industry standard

- Familiarity with federal and state requirements

Fraud and Chargeback Protection

Greater scrutiny inevitably means higher risk of fraud and chargebacks. Moreover, the best vape store online payment gateways offer features for detecting fraud to minimize losses.

Prioritize gateways offering:

- Real-time fraud detection

- 3D Secure (such as Verified by Visa)

- Chargeback notifications and representation services

- Specialized guidelines about abnormal activity

These tools shield your business and help you maintain your status with acquiring banks.

Global Coverage and Multiple Currencies

If you sell overseas, choose a payment gateway that accepts global payments and multiple currencies. This means you can grow your customer base, while still adhering to local regulations.

Check for:

- International card acceptance

- Multi-currency settlement

- Global KYC/KYB compliance

- Checkout language localization

A worldwide gateway would allow your vape shop to expand across borders.

Integration With E-commerce Platforms (Shopify, WooCommerce, etc.)

When choosing payment gateways, it must be among the certified payment providers that can integrate with Shopify, WooCommerce, BigCommerce, or Magento. Vape-friendly suppliers may have plugins or APIs to make integration easy.

Look for:

- Direct plugins or app integrations

- API access for customized solutions

- Synchronization with your inventory/order systems in real time

- Checkout options that are mobile friendly

Smooth integration equals less cart abandons and a better customer experience.

Reasonable Fees and Transparent Pricing

Vape businesses are already paying greater processing rates because of their risky nature. However, your gateway needs to have clear pricing with zero hidden fees and no long-term lock-in contracts.

Key things to compare:

- Setup or monthly fees

- Per-transaction rates

- Rolling reserve requirements

- Chargeback handling fees

Some payment gateways focus on high-risk industries but you can still get a good deal if you look around.

Top 6 Payment Gateways for Online Vape Stores in 2025

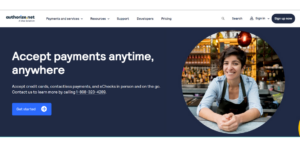

1. Authorize.Net

Key Features:

- Seamless integration with Shopify, WooCommerce, Magento

- Fraud detection suite (AFDS)

- Accepts credit cards, e-checks, and recurring payments

Pros:

- Trusted brand backed by Visa

- Advanced fraud filters and secure checkout

- Broad compatibility with major platforms

Cons:

- Requires a high-risk merchant account via a reseller

- May not approve direct vape applications

Pricing Summary:

- $25 monthly gateway fee

- 9% + $0.30 per transaction (via reseller)

- Custom rates for high-risk verticals

Vape Merchant Support:

Authorize.Net supports vape merchants only through partnered resellers who specialize in high-risk accounts.

2. PayKings

Key Features:

- Dedicated vape merchant solutions

- Direct high-risk merchant onboarding

- Chargeback protection and fraud prevention tools

Pros:

- One of the few gateways openly serving vape businesses

- Personalized risk underwriting

- Transparent account management

Cons:

- May require rolling reserves

- Custom onboarding timeframes

Pricing Summary:

- Custom pricing based on business profile

- Typically 2.5–4.5% + per-transaction fees

- No setup fees in most cases

Vape Merchant Support:

PayKings is fully vape-friendly and supports CBD, e-liquids, and tobacco-alternative product sales.

3. Easy Pay Direct

Key Features:

- EPD Gateway tailored for high-risk industries

- Load-balancing through the EPD “bridge” system

- Full PCI DSS compliance

Pros:

- Supports large transaction volumes

- Intelligent routing to reduce decline rates

- Excellent high-risk reputation

Cons:

- Premium pricing

- Setup time can take up to two weeks

Pricing Summary:

- Setup fee: $99–$199 (depending on business type)

- Transaction fees: 2.5%–4.99% + $0.25

- Monthly fee: $25–$35

Vape Merchant Support:

Strong support for vape and e-cigarette merchants, including those with prior processor issues.

4. PaymentCloud

Key Features:

- Specializes in high-risk merchant accounts

- Free EMV-compatible terminals for in-person sales

- Chargeback mitigation via Verifi and Ethoca

Pros:

- High approval rates for vape and CBD products

- Hands-on account reps

- No application or setup fee

Cons:

- Website lacks transparent pricing

- Not ideal for international merchants

Pricing Summary:

- Pricing is quote-based

- Typically ranges 2.9%–4.5% per transaction

- No monthly minimums

Vape Merchant Support:

PaymentCloud is known for reliable vape merchant support, even for startups or previously rejected businesses.

5. Instabill

Key Features:

- Offshore and domestic merchant accounts

- Multi-currency and international payment support

- Advanced fraud scoring and risk control tools

Pros:

- Excellent for global vape sales

- Offers offshore banking for restricted markets

- Experienced in high-risk verticals

Cons:

- Long onboarding times (1–3 weeks)

- Strict documentation requirements

Pricing Summary:

- Transaction rates: 3%–6% + variable monthly fees

- May require rolling reserve of 5%–10%

Vape Merchant Support:

Instabill is a go-to for international vape sellers, particularly those outside the U.S. or seeking offshore options.

6. Durango Merchant Services

Key Features:

- Custom-built high-risk payment solutions

- Virtual terminal and mobile payment options

- Tokenized payments and recurring billing

Pros:

- Exceptional customer support

- Secure gateway and robust API

- Trusted partner for niche industries

Cons:

- Pricing varies greatly by risk level

- Application process may take longer

Pricing Summary:

- Transaction rates: 2.85%–4.5%

- Monthly fees: Around $25

- Custom reserve based on risk score

Vape Merchant Support:

Durango is a long-standing provider in the vape and cannabis space, offering tailored support for age-restricted goods.

Tips for Getting Approved as a Vape Merchant

Applying for a vape merchant account is more than just completing a form. And because of obstacles facing vape businesses at the federal level, you have to show your potential to be a stable, compliant and reliable business. This is how you can improve your odds of getting approved.

Prepare Documentation

Compile all necessary documents to begin with. Most payment gateways prefer to see the whole picture of your business to assess risk properly.

Make sure to have:

- A legitimate business license for sales of tobacco or vape products

- Elaborate product explanations with information on nicotine strength and ingredients

- Complete the fulfillment process for your site, including shipping partners and shipping times.

- An operational e-commerce webshop (with SSL) with a privacy policy, refund policy, terms of service, age verification mechanism

The more prepared you are, the more professional you look — and that eases the risk analysis process.

Maintain a Clean Processing History

If you have previously accepted payments, your processing history will be closely reviewed. Banks and processors consider historical chargeback ratios, refund percentages and monthly volumes.

To improve your approval odds:

- Maintain chargebacks under 1% (industry standard)

- Offer timely customer service to settling disputes

- Avoid Excessive refunds especially for high-dollar amounts

- Don’t hide former accounts that were closed — be upfront

When you present a clean record, it shows that you are at low-risk despite the industry classification.

Work With High-Risk Merchant Account Specialists

You can also consider consulting with a high risk merchant account provider who can approve you. These are providers who know the compliance environment and are in good standing with acquiring banks that underwrite vape-related businesses.

They help with:

- Choosing the right acquiring bank

- Preparing your application for maximum success

- Structuring your account to avoid future issues

Conclusion

Selecting from the list of payment gateways for vape shop is not simply about processing payments—it’s about mitigating risks, keeping compliant and boosting conversions. With the vape market under increasing regulatory scrutiny, it only makes sense to work with companies with expertise in high-risk payment solutions.

The high-risk merchant account providers know the industry well. They provide the unique tools, risk management, and support required to confidently operate your store in 2025 and beyond.

Hence, you must do your research, compile all the necessary documents, and select the right payment gateway for your business.

Frequently Asked Questions

1. Why are vape stores considered high-risk by payment processors?

Vape stores face strict regulations, age restrictions, and a higher rate of chargebacks. These factors classify them as high-risk merchants, making many traditional processors unwilling to support them.

2. Can I use Shopify Payments for my online vape store?

No. Shopify Payments prohibits the sale of vape and tobacco products. However, you can still use Shopify’s platform by integrating a third-party high-risk payment gateway like Authorize.Net (via a reseller) or PayKings.

3. What documents do I need to get approved?

You typically need a business license, government-issued ID, product list, website with legal pages, fulfillment details, and proof of a secure checkout system. Some providers may ask for bank statements and processing history.

4. What happens if I use a traditional processor for vape sales?

Using a mainstream processor like PayPal or Stripe may result in account freezes or termination, especially if they detect vape-related transactions. It’s best to work with vape-friendly payment gateways from the start.

5. Are there any upfront fees to set up a vape merchant account?

It depends on the provider. Some charge setup or monthly fees, while others offer custom pricing based on risk. Always request transparent pricing and avoid gateways with unclear or hidden charges.